child tax credit october 2021

3600 for children ages 5 and under at the end of 2021. October can scare up several reasons to think about taxes including wondering when the next child tax credit payment will arrive.

Recovery Package Should Permanently Include Families With Low Incomes In Full Child Tax Credit Center On Budget And Policy Priorities

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

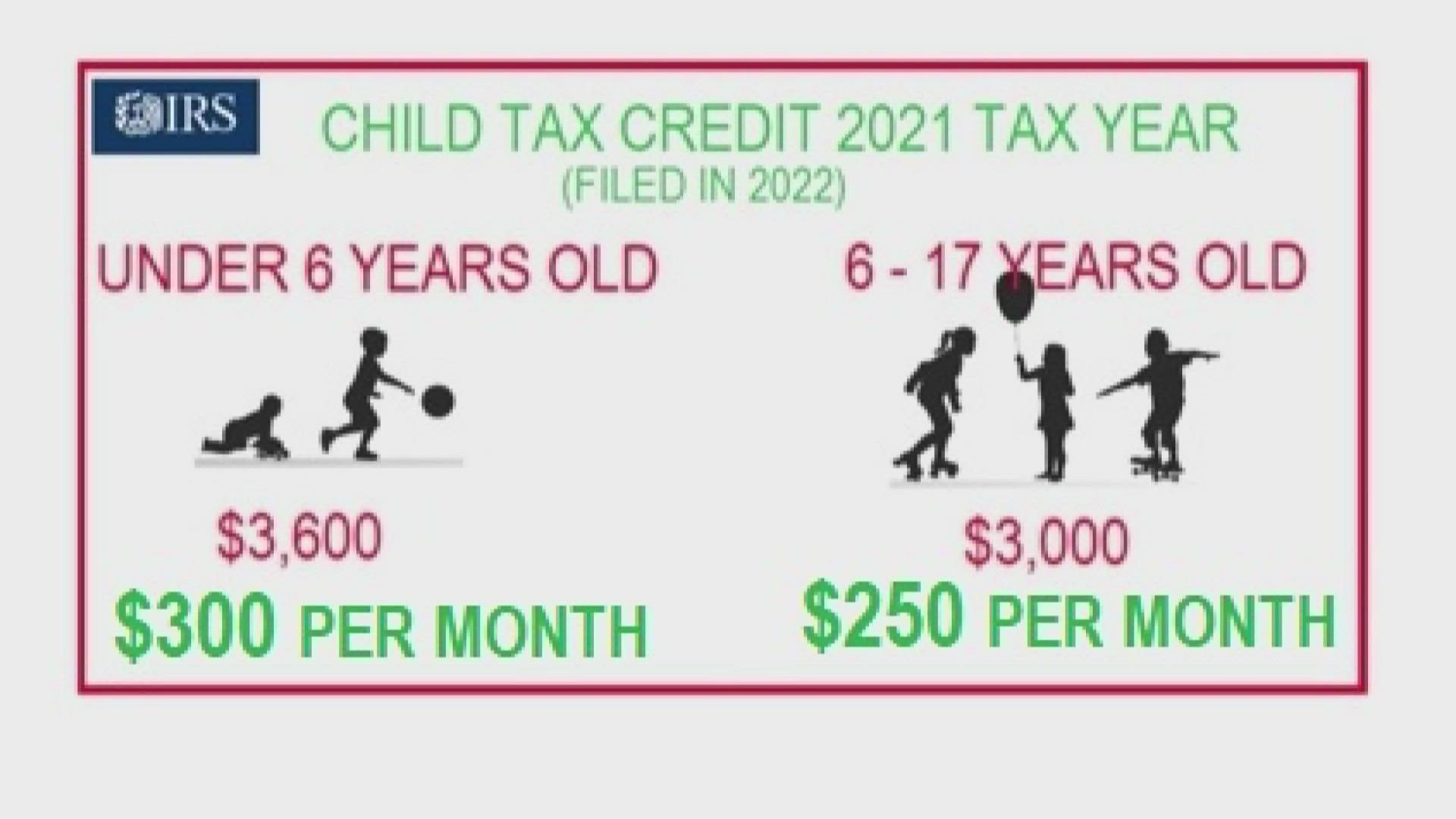

. CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days. The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger.

All eligible families could receive the full credit if. As part of the. The Child Tax Credit reached 611 million children in.

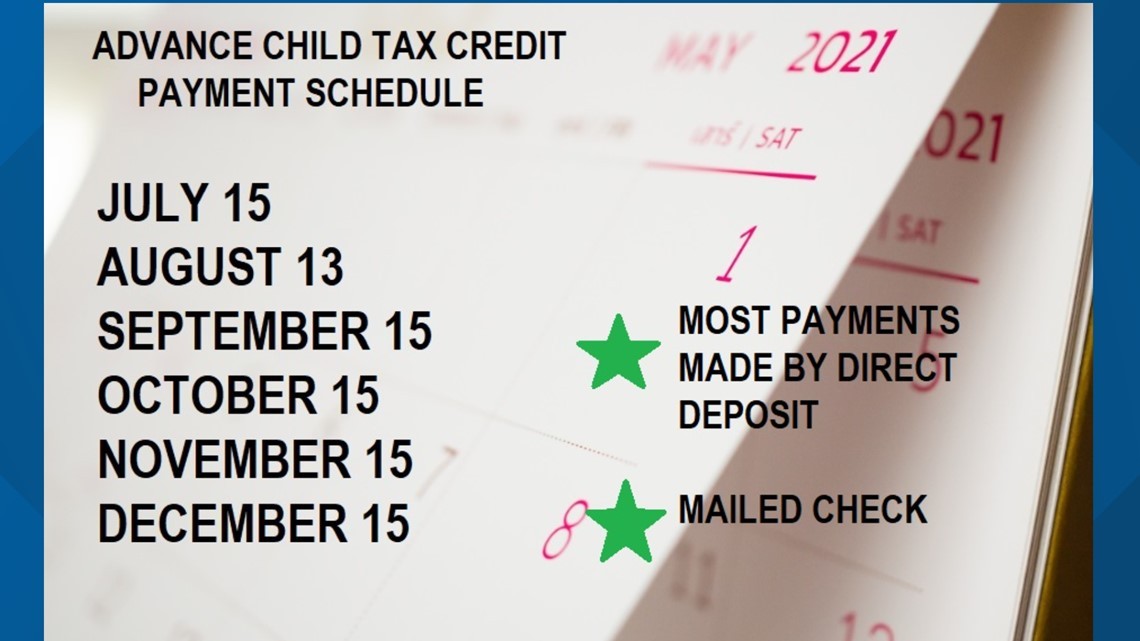

Wait 5 working days from the payment date to. All payment dates. The fourth advance child tax credits payment will land in bank accounts and as paper checks on October 15.

Starting July 15 and continuing through December 2021 the new federal Child Tax Credit in the American Rescue Plan Act provides monthly benefits up to 250 per child. All eligible families could receive the full credit if. October 14 2021 559 PM CBS Detroit.

Well tell you when this payment will arrive and how to. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. For families with qualifying children who did not turn 18 before the start of this year the 2021 Child Tax Credit is.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. 3000 for children ages 6. That means another payment is coming in about a week on Oct.

Most families are eligible to receive the credit for their children. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. Most of us really arent thinking tax returns in mid-October.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. IR-2021-201 October 15 2021. If a taxpayer wont be claiming the child tax credit on their 2021.

The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. To reconcile advance payments on.

The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger. Havent received your payment. We explain the key deadlines for child tax credit in October.

Changes in income filing status the birth or. Have been a US. You received advance Child Tax Credit payments only if you used your correct SSN or ITIN when you filed a 2020 tax return or 2019 tax return including when you entered.

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of. October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

The IRS will soon allow claimants to adjust their.

November 15 2021 Deadline For Non Tax Filing Families To Use Child Tax Credit Portal Lone Star Legal Aid

Advance Child Tax Credit Update October 8 2021 Youtube

Child Tax Credit Updates Why Are Some Payments Lower In October As Usa

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Child Tax Credit Update November 15 Sign Up Deadline Marca

All You Need To Know About The New Child Tax Credit Change

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Padden Cooper Cpa S Remember That The Child Tax Credit Is Optional If You Request It Now You Cannot Claim It Later On Your Taxes For More Help Call 609 953 1400 Childtaxcredits Taxes

How Much Money Has The Child Tax Credit Given Families In 2021 As Usa

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

Tax Tip 2021 Advance Child Tax Credit Information For U S Territory Residents Tas

Child Tax Credit Update 2021 Parents Warned To Register For Monthly Payments Now As October Deadline Approaches The Us Sun

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

You May Be Surprised By Cuts In October Child Tax Credit

Child Tax Credit 2021 8 Things You Need To Know District Capital

The Child Tax Credit Toolkit The White House

Child Tax Credit Growing Up In Santa Cruz

Taxpayer Advocate On Twitter If You Ve Moved Update Your Address By Midnight Eastern Time On October 4th To Change Your Mailing Address For Your October Advance Child Tax Credit Payment Use The