city of richmond property tax inquiry

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. Search Any Address 2.

Pointe At River City Apartments Richmond Va 23223

Richmond residents will have until July 4 to pay their property taxes.

. Property Information Search Portal Choose a search option from the first drop down box below and follow search instructions as noted. Real Estate and Personal Property Taxes Online Payment. This information helps the City identify which property to.

Start Your Homeowner Search Today. Other Services Adopt a pet. Ad Dont Make an Expensive Mistake.

Gross taxes levied. Get In-Depth Property Tax Data In Minutes. The results of a successful search will include the outstanding.

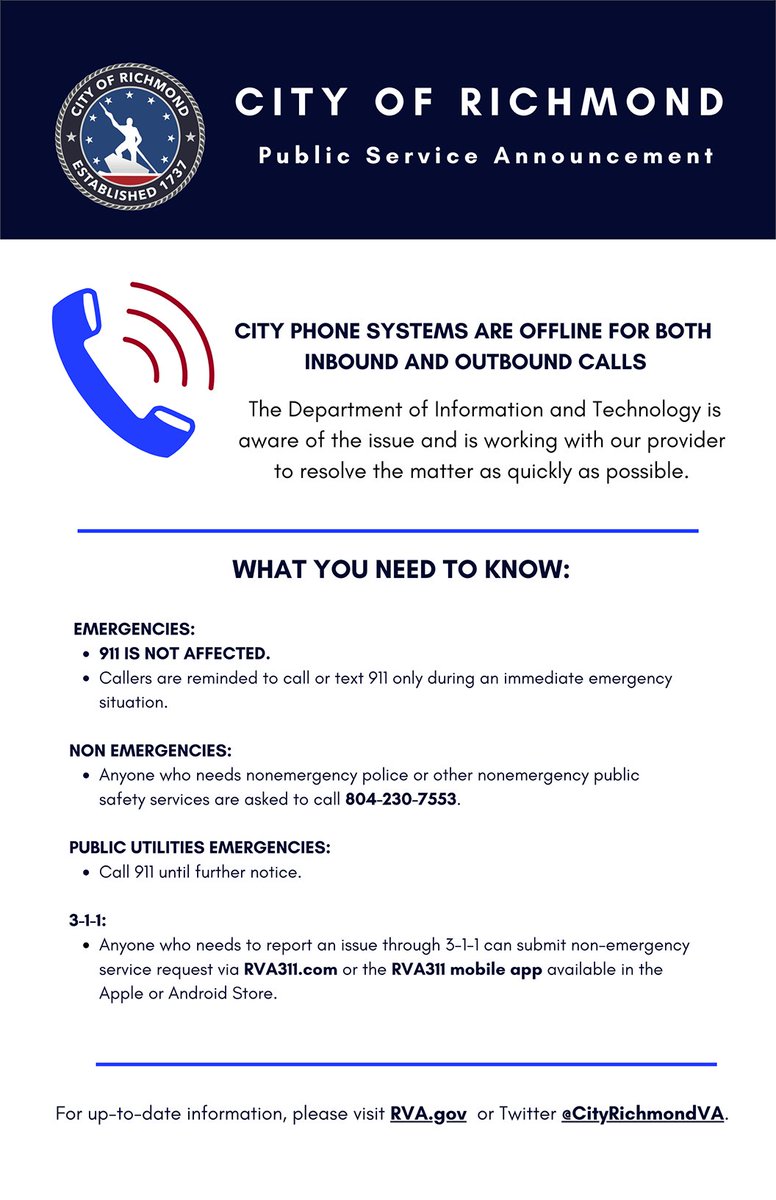

Use this form to report non-emergency concerns regarding your property services and utilities or problems in your neighbourhood like street lights out or. City of Richmond Tax Department 6911 No. Information and Non-Emergency Services.

Call or text 911 Non-Emergency Police. Property Tax Vehicle Real Estate Tax. All City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to paying 2019 or newer property taxes to the Ray County Collector.

Payment of Property Tax with Credit Card. Richmond BC V6Y 2C1 Include your account information on the cheque. Report a Problem Request a Service.

Informal. Due Dates and Penalties for Property Tax. Find City Property Records.

The results of a. Please contact the Commissioner of Revenue at 804-333-3722 if you have a question about your assessment. Obtain a free uncertified Property Report on any Richmond property.

The propertys Parcel ID should be entered such as W0210213002. Find Property Records You Can Trust For City. See Property Records Tax Titles Owner Info More.

295 with a minimum of 100. Search by Parcel IDMap Reference Number. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate.

Personal Property Taxes Personal Property taxes are billed annually with a due. The City Assessor determines the FMV of over 70000 real property parcels each year. City of Richmond Parcel Tax Search.

Understanding Your Tax Bill. Land Use Housing and Transportation Standing Committee Meeting - September 20 2022 at 130 pm. Property Inquiry The report will include.

Electronic Check ACHEFT 095. RICHMOND CITY HALL 450 Civic Center Plaza Richmond CA 94804. Finance Taxes Budgets.

This utility allows a person to interactively search for City of Richmond real estate tax information based on Parcel ID or Address. Visit our Property Inquiry application. To create an online payment of the Richmond property tax bill we must select the Proceed to Payment option in the Inquiry section.

Call 3-1-1 or 804-646-7000. Monday July 4 2022. Manage Your Tax Account.

Property Taxes are due once a year in Richmond on the first business day of July. This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc.

/cloudfront-us-east-1.images.arcpublishing.com/gray/O6AWGSWEWZDDLD2MN6FLHIEMDE.jpg)

Richmond Mayor S 836 Million Budget Includes Pay Raises For Police Fire And City Employees

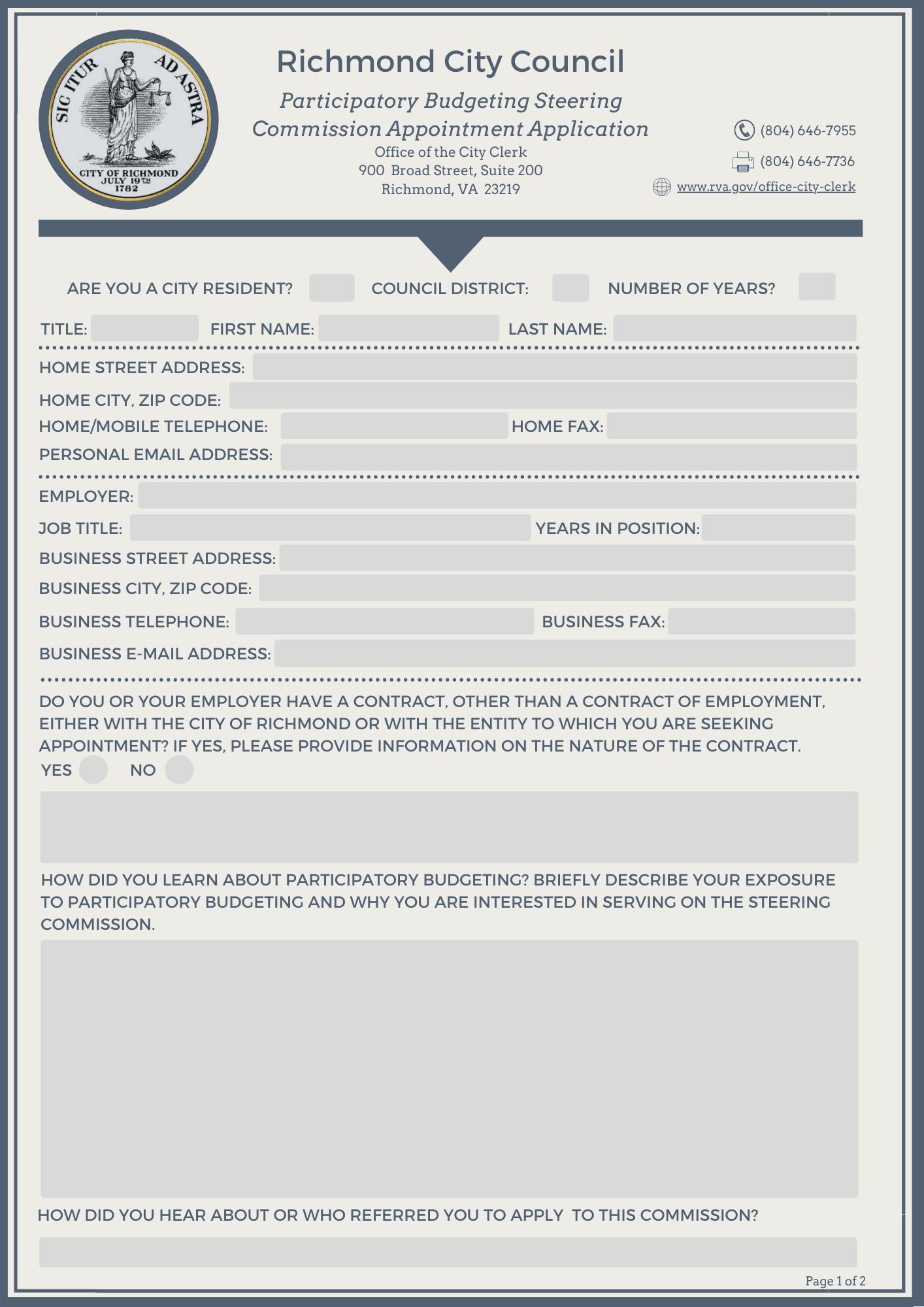

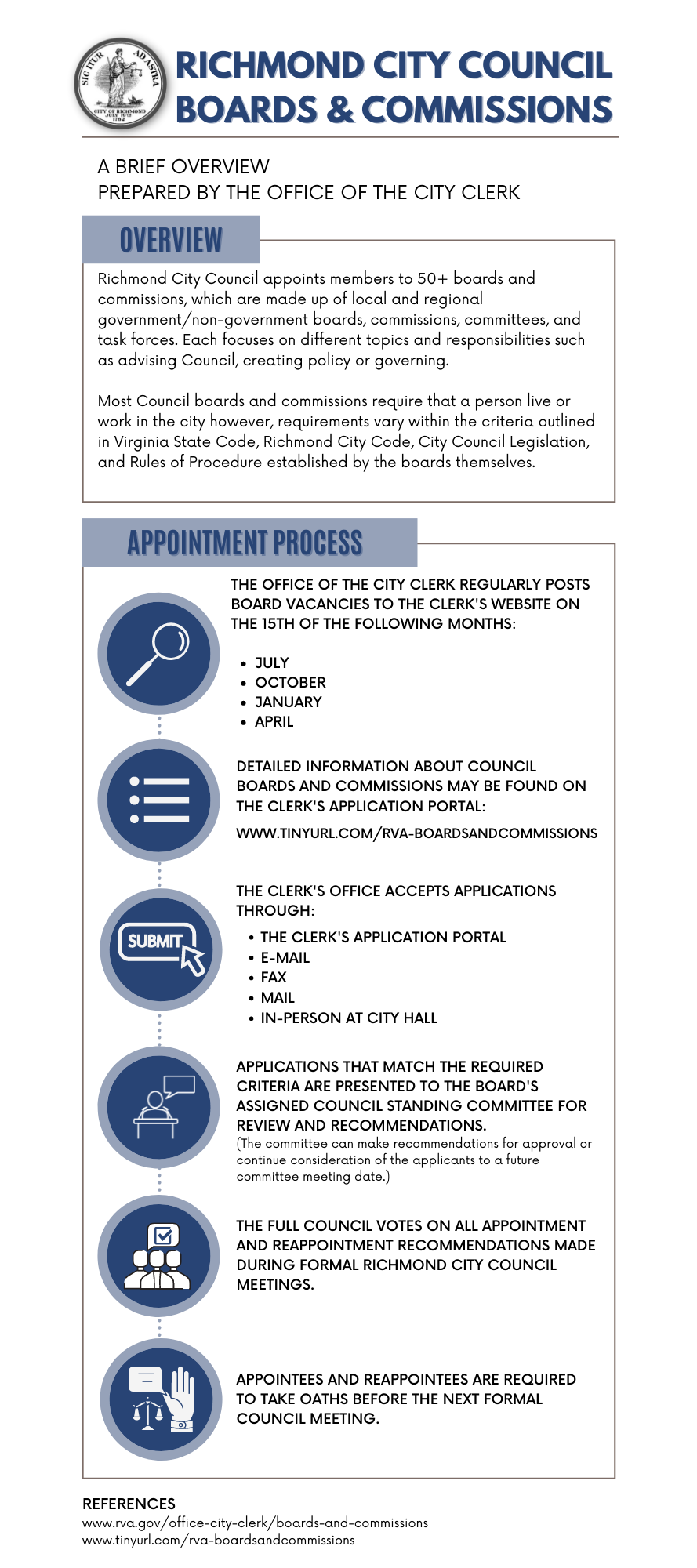

Boards And Commissions Richmond

Property Tax Billings City Of Richmond Hill

Municipal Court City Of Richmond

Rs Portofino Ext Real Estate New Construction House Styles

We Want More People To Participate Richmond Encourages Homeowners To Apply For Real Estate Tax Relief Program

Boards And Commissions Richmond

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

How 15 Canadian Cities Got Their Names Infographic Infographic City Canadian

Property Tax Billings City Of Richmond Hill

Boards And Commissions Richmond